when will capital gains tax increase uk

1514 Wed Sep 2 2020. The table below shows.

Capital Gains Tax What Is It When Do You Pay It

How you report and pay your Capital Gains Tax depends whether you sold.

. For those on basic rate income tax the rate will depend on the size of the gain taxable income. It implies that capital gains of up to 12300 are tax-free. For those who pay a higher rate of income tax or a trustee or business the rate is currently 28 per cent on gains from residential property and 20 per cent on gains from other chargeable assets.

1514 Wed Sep 2 2020 UPDATED. The amount of tax you need to pay depends on the amount of profit you make when you sell shares. The current operation of the capital gains tax system is a recognised issue.

Taxes united-kingdom capital-gains-tax capital-gain. The 3tn windfall from soaring house prices in the past 20 years should be subject to a capital gains levy so that poorer households can. Three times as many people will have to pay capital gains tax under plans to pay for the cost of the pandemic put.

First deduct the Capital Gains tax-free allowance from your taxable gain. What you need to do. Exclusive analysis of 540000 wealthiest individuals in the UK shows effects of low capital gains tax Why capital gains tax reform should be top of Rishi Sunaks list The maximum UK tax rate for.

In the UK gains made by companies fall under the scope of corporation tax rather than capital gains tax. Capital gains tax rates for 2022-23 and 2021-22. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

20 for companies non-resident Capital Gains Tax on the disposal of a UK residential property 6 April 2016 to 5 April 2017. Previously there had been a window of just 30 days for taxpayers to report the gain and pay the tax owed - as of the Budget on 27 October 2021 - this was immediately increased to 60 days. In 201718 total capital gains tax receipts were 83 billion from 265000 individuals and 06 billion from trusts on total gains of 589 billion.

CAPITAL GAINS TAX may see a huge hike in a bid to raise more money following the expense of the coronavirus pandemic. If a persons taxable. If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax.

The capital gains tax rate on shares is 10 for basic rate taxpayers and 20 for high rate taxpayers. However there is a tax-free allowance of 12300 for individuals. But will the tax increase this year.

Or could the tax rate be retroactively applied to the 202122 tax year. The Office for Tax Simplification in their report suggested that Capital Gains Tax be aligned with Income Tax rates. The increase would be substantially bigger from 20 to 45 therefore it would be good to know if this does take place should assets be sold off before the end of this tax year.

Capital Gains Tax increase 2020. From 6 April 2022 Class 1 and Class 4 national insurance contributions are set to increase by 125 percentage points for anyone earning above the primary threshold of 9880. Will tax increase this year.

CAPITAL GAINS TAX and Inheritance Tax changes could be on the horizon for Britons despite the Chancellor failing to make any significant alterations to the levies in yesterdays Budget an expert. OTS proposals suggested bringing Capital Gains Tax in line with Income Tax currently charged at a basic rate of 20 percent and rising to 40 percent for higher rate taxpayers. In the last tax year of 2019-2020 HM Revenue Customs collected record amounts of capital gains tax as experts predicted this figure would continue to rise.

A residential property in the UK on or after 6 April 2020. This is effectively a tax rise. Capital Gains Tax is a confusing subject for many but the general rule is that Britons have a tax-free allowance which currently stands at 12300 or 6150 for trusts.

Something else thats increased in value. By Harry Brennan 11 November 2020 136pm. The following Capital Gains Tax rates apply.

Capital gains tax reporting extended Another announcement in the Autumn Budget 2021 affects anyone who makes a capital gain after selling a property. Legislation will be introduced in Finance Bill 2016 to amend subsections 4 2 3 4 and 5 of TCGA to reduce the 18 and 28. Add this to your taxable income.

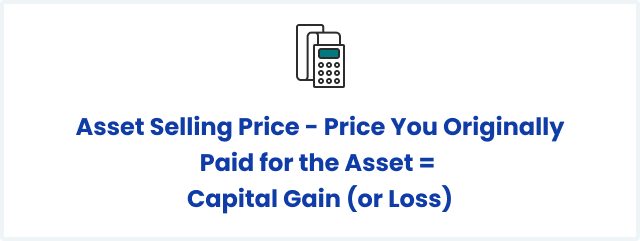

OTS proposes higher rates of CGT. CGT is a tax on the profit when you sell an asset that has increased in value.

Capital Gains Tax What Is It When Do You Pay It

Real Estate Capital Gains Tax In South Carolina What Is It And How To Avoid It

2022 And 2021 Capital Gains Tax Rates Smartasset

Capital Gains Tax What It Is How It Works What To Avoid

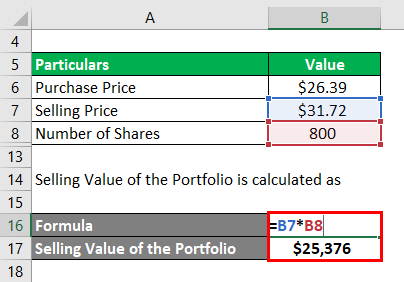

Capital Gains Yield Cgy Formula Calculation Example And Guide

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

2022 And 2021 Capital Gains Tax Rates Smartasset

Uk Defi Tax On Loans Mining Staking Koinly

How Much Is Capital Gains Tax On Real Estate Plus How To Avoid It

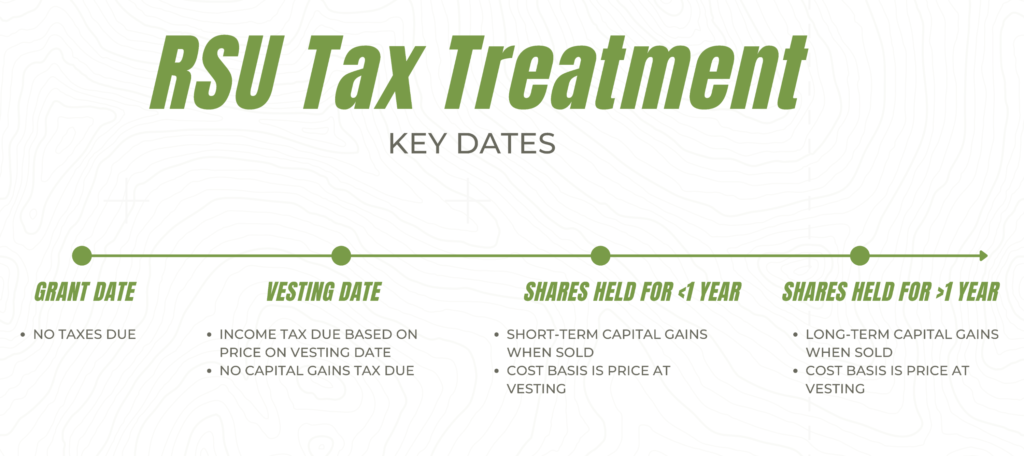

Rsu Taxes Explained 4 Tax Strategies For 2022

Difference Between Income Tax And Capital Gains Tax Difference Between

How Much Tax Will I Pay If I Flip A House New Silver

What Are Capital Gains Tax Rates In Uk Taxscouts

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

Capital Gain Formula Calculator Examples With Excel Template

Difference Between Income Tax And Capital Gains Tax Difference Between

Uk Capital Gains Tax For Expats And Non Residents Expert Expat Advice